Charity Donation Help & FAQ

How does eBay for Charity work?

eBay for Charity has partnered with the PayPal Giving Fund to make it easy for sellers to donate 10% to 100% of your item's final sale price to a certified charity.

It's as easy as 1 - 2 - 3!

- SELECT CHARITY

- Seller picks the charity and the donation percentage when listing an item

- SELL & DISPATCH

- Item sells

- Buyer pays full amount to seller

- Seller dispatches item to buyer

- DONATE

- Once a month PayPal Giving Fund will combine and deliver 100% of all donations received for that charity

* If your donation cannot be received automatically then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation.

Are you an employee or authorised agent of a charity?

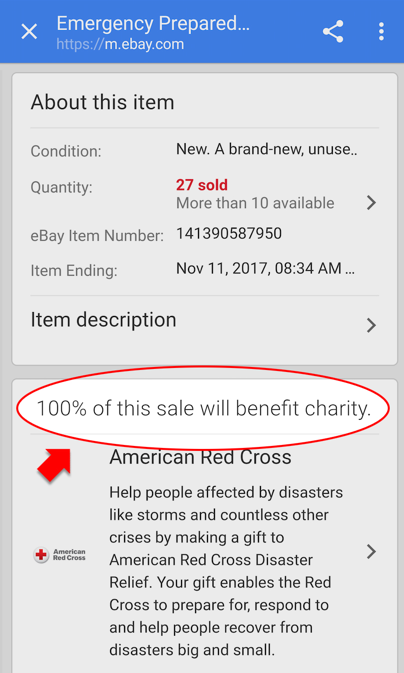

If you are listing items on eBay directly for a charity, such as you are an employee or an authorised agent of the charity, you should onboard yourself as an eBay charity direct seller. After you do so, when you list an item for your charity, eBay will automatically choose 100% as the donation percentage and the proceeds from the sale will go directly to the charity. Learn more about getting your account set up as a Direct Seller.

Are you a standard seller on eBay?

If you don’t work on behalf of a charity, all you need to do is add the charity and donation percentage to your listing and after the item sells and the buyer pays, the system will automatically receive your donation through our charity partner, the PayPal Giving Fund. PayPal Giving Fund will email you with a donation receipt. Then, once per month, the PayPal Giving Fund consolidates all the donations received for that charity in a single payment. If your donation cannot be received automatically as the functionality is not yet available to you, then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation

Payouts are made to your bank account in line with the Payment Terms of Use. The payout schedule can be managed through Seller Hub.

What are the benefits to selling for charity?

- Items tend to sell more often and at higher prices because buyers are more willing to purchase items that benefit a charity

- Your item will stand out because we add a unique charity ribbon icon to the search view and the full details of the charity donation on the item description

- Your item will appear in searches where buyers are specifically looking for items that benefit charity

- If the item sells, the variable portion of your final value fees will be discounted by the same percentage that you donated, up to 100%. For example, if you donate 25% to charity then you will get a 25% discount on your final value fees, and 100% discount if you donate 100%.

- If you donate 100%, your per order fee and your final value fee are waived.

I’m listing items on behalf of a charity. Do I need to do anything differently?

If you are listing items on eBay on behalf of a charity, as an employee or authorised agent, you are considered a "Charity Direct Seller". When you list an item and select that charity, eBay will automatically choose 100% as the donation percentage and the proceeds from the sale will go directly to the charity. Make sure that your account is set up as a charity direct seller. Learn more about getting your account set up as a Direct Seller.

What is the PayPal Giving Fund?

PayPal Giving Fund (PPGF) is a registered not-for-profit that connects donors, businesses and charities in order to help charities raise new funds. eBay for Charity works directly with the PayPal Giving Fund to enable sellers to donate a portion of their sales and buyers to shop while supporting their favourite charity. It's a win-win opportunity!

Thanks to operating support from PayPal, 100% of every donation processed by PayPal Giving Fund reaches the donor's chosen charity organisation. And because PayPal Giving Fund is itself a not-for-profit, 100% of your donation amount is tax deductible to the extent allowed by law.

PayPal Giving Fund also certifies the charity, provides donation and donor reports, issues tax receipts, aggregates donations for monthly electronic distribution and handles legal registration requirements. Learn more about the PayPal Giving Fund.

1. SELECT CHARITY

How do I add charity to my listings?

- In the listing flow, select the Donate a portion to Charity option

- Select a charity* from the list of available options or search for a different charity

- Select the percentage you would like to donate to charity

- You can verify the charity and donation percentage by checking the information included in the item description

* The charity you select will be notified of your listing according to its account preferences and has the right to request an item cancellation if it prefers not to benefit from your listing.

How do fee discounts work on charity listings?

If you are not a nonprofit and you list and sell on eBay to support a charity, eBay will discount the variable portion of the final value fees, equal to the donation percentage, up to 100%.

Here is an example:

Auction starting price = £10

Postage = £10

Final sale price = £100

Total amount of sale = £110

Final value fee = final value fee % + 30p per order

Final value fee % = 10%

Total basic selling fees = £11 + 30p

Elected donation percentage = 50%

Discount on final value fee = 50% x £11 = £5.50

For complete details of seller payment fees, please refer to the Payments Terms of Use.

Note: Other credits may be issued for impacted sellers in service metrics with a Very High rating for Item Not as Described returns. See the Service Metrics Policy for more information.

How do I add, change or remove the charity on my listing?

Use the revise listing tools in the selling section of eBay.co.uk to make changes. Most of the time you can add, change or remove a charity, or adjust the donation percentage on your active listing as long as it meets the following criteria:

- Your auction item has no bids

- Your fixed price item has no pending transactions or offers

I am unable to change the charity or donation percentage on my item. Why?

You can't make changes to the charity or the donation percentage when:

- Your auction item has bids on it

- Your fixed price item has pending transactions or offers

I am unable to add charity to my listings if I use offline payments. Why?

We are currently unable to support a charity donation to your listing at the same time as offline payments. Please disable offline payments (e.g. cheque, postal order, payment upon collection) in your listing supporting your favourite charity.

My charity listing was removed. Why?

There are many reasons that a listing might be removed - see the original email you were sent or contact customer service to find out why. There are two charity-specific reasons that typically apply:

- The charity may ask eBay to remove an item listed on their behalf

- The charity's account has been closed by the PayPal Giving Fund

Are there any item or category restrictions for charity listings?

Yes, there are some limitations on what items and categories can be included in an eBay for Charity listing. For a complete list, please go to Rules about Prohibited and Restricted Items.

Also, the not-for-profit that you select has the right to request an item cancellation if they prefer not to be associated with your listing.

2. SELL & DISPATCH

* If your donation cannot be received automatically then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation.

What should I expect after my charity item has sold?

After your item has sold and you’ve been paid by the buyer, ship the item as quickly as possible. Your donation will automatically be collected at the time of the transaction. You will also receive a receipt from PayPal Giving Fund within 21 days of the order being paid. You can find more information on your Donation Account Dashboard. If your donation cannot be received automatically as the functionality is not yet available to you, then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation

Make sure that you have set up a charity payment method.

Your donation will be automatically collected at the time of transaction. If we have technical issues, or your donation cannot be received automatically, we will invoice you for the donation amount, which you can pay through any convenient method of payment.

What if the buyer doesn't pay

We will not receive the charity donation, and your donation will not be processed until the buyer has paid.

What if I refund the buyer for a return, for reporting an item hasn't arrived, or for a cancellation?

- If a refund is completed before your donation is sent to the charity, the donation amount will be included in the refund to the buyer and you will be responsible for the remaining amount, less any applicable fees.

- If a refund is completed after your donation has been sent to the charity by PayPal Giving Fund, you are responsible for the full refund and will need to contact the charity directly to request a reimbursement of the donation amount.

You can check the status of your outstanding donation payments and pay your invoices from your Donation Account Dashboard.

3. DONATE

How and when will my donations be paid to the charity?

Our charity partner, PayPal Giving Fund, automatically receives donations after your item sells. Once your donation is successfully received, you will receive an email indicating that your donation has been received, which is your official tax receipt as well. If your donation cannot be received automatically as the functionality is not yet available to you, then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation

The PayPal Giving Fund combines donations received from eBay sellers from the 16th of the previous month to the 15th of the current month and delivers a single donation to the charity's PayPal account. For example, if a donation is paid on 10 October, the donation will be delivered to the charity at the end of October. However, if a donation is paid on 20 October, the donation will be delivered to the charity at the end of November.

Can I also use Gift Aid with my eBay for Charity donation?

Yes. Gift Aid is one of the easiest ways to make your donation tax effective. Using Gift Aid means that for every pound you give, the charity will receive an extra 25p from the government.

Simply log into PayPal Gift Aid to make your declaration. When your charity item sells, provided you pay more in UK income or capital gains tax than you're asking charities to claim back in each tax year, the PayPal Giving Fund will receive the Gift Aid from the government and pass it on to your chosen charity.

Why am I being invoiced from PayPal Giving Fund?

eBay for Charity has partnered with the PayPal Giving Fund to receive donations from eBay sellers and deliver them to the charity. If your donation cannot be received automatically then you will receive an invoice payable to the PayPal Giving Fund requesting payment for the donations due. You can pay these invoices with credit card, PayPal, bankcard or other supported payment types. You can check to see if you have a charity payment method from your Donation Dashboard on the Settings tab.

If I delete the invoice email from PayPal, how can I pay my invoice?

You can check the status of your outstanding donation payments and pay your invoices from your Donation Account Dashboard.

Can I pay my donation directly to the charity instead of paying PayPal Giving Fund?

No - please allow our automated systems to receive your donation due. If you pay the charity directly, our systems will think you have outstanding donations due and your account may be restricted from listing items that benefit charity. Also, when paying your donation through the PayPal Giving Fund you receive an official tax receipt. All your outstanding donation payments and invoices can be found on your Donation Account Dashboard.

Where can I find a summary of all the donations that I’ve made?

Go to the History tab of your Donation Account where you can select the desired year to see all the donations you made that year. You can export that information into an Excel table if you want to save or print the yearly summary for your records.

How do I cancel a charity donation or invoice?

When you add a donation to a listing, you are responsible for the donation, including refunds, and required to pay that donation to the charity. In the rare instance that you would like to cancel a donation or invoice, you can do so by signing into your Donation Account and following the instructions below.

- If you are cancelling a donation that has not been invoiced, you can do so by visiting the Pending Donations tab within your Donation Account Dashboard. There you'll see the donations eligible for cancelling.

- Click or tap the "Request Cancellation" button and complete the online form.

Once the donation cancellation is complete, you can view your cancelled donation from the History tab in your Donation Account Dashboard.

Once a pending donation is cancelled, you will not receive an invoice or get charged for the donation amount.